A day and a ½ workshop where sales professionals gain practical experience in budgeting, targeting, forecasting, and measuring performance.

Business Challenges Solved with This Course

Delivery Options

Finance for Sales Professionals

In Finance for Sales Professionals, salespeople become competitive in all areas of business. They develop their planning and analysis skills and gain practical experience in budgeting, targeting, forecasting, and using a variety of performance metrics. Sales Professionals gain clear understanding of business dynamics and the financial statements that impact the business.

What You Can Expect From This Course

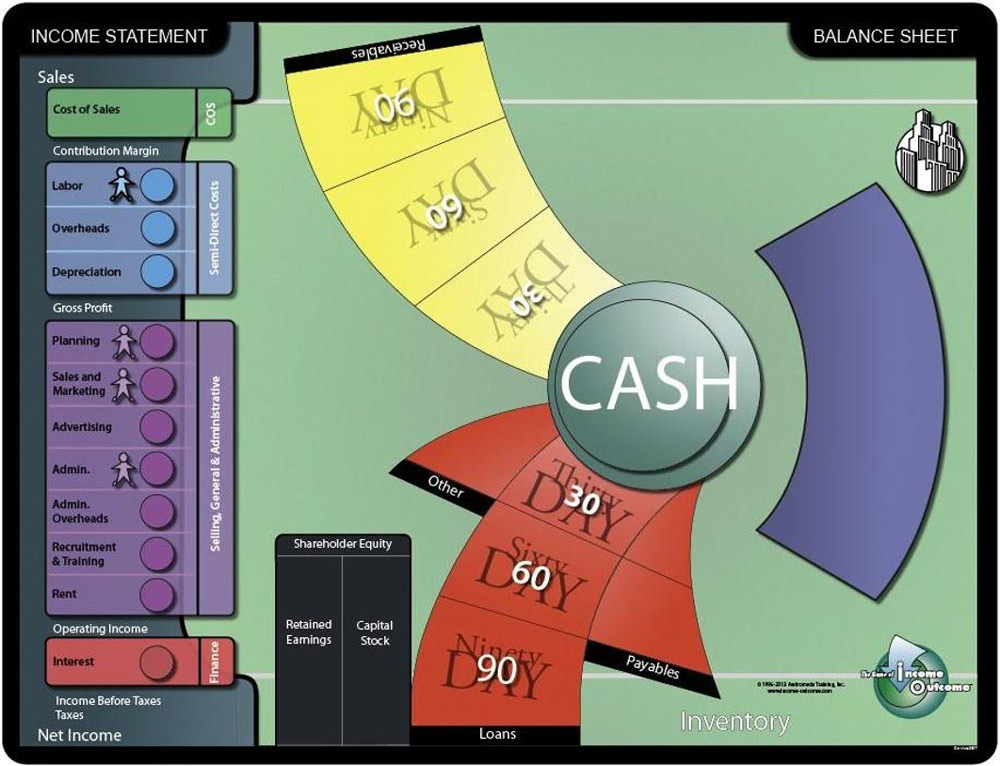

Developed by Andromeda Simulations International, Income:Outcome Finance for Sales Professionals is a full day and a 1/2 simulation that utilizes the Income/Outcome simulation board to allow sales professionals to manage their companies through a simulated year, looking at short-term results and long-term goals. This involves forecasting and constant decision-making on such issues as pricing, capacity, borrowing, R&D, cost structure, and cash flow.

Facilitator-Led Simulation

This group experience provides the rules for the simulation, a general introduction to the process of business (financial statements, business terminology, fundamental business dynamics), and sets the framework of needing to manage separately for cash and profit.

Team Competition Simulation

Team competition consisting of six business cycles in which teams have full decision-making power and are accountable for the results.

In each cycle, team-based companies develop and implement a business strategy which incorporates real-world dynamics: production capacity, customers, prices, financing, and more. Each cycle includes the following activities:

- Examining market drivers: supply and demand, niche marketing, quality

- Competitor awareness, setting prices in a competitive market

- Ongoing strategic analysis, updating the strategic plan in response to changes in the industry and in the marketplace

- Budget and cash flow exercises

- Monitoring cash flow

- Maintaining the ‘books’ of the operating company (Income Statement and Balance Sheet)

- Performance measurement and analysis

- Posting, comparing, and discussion of results

- Other activities include competitor analysis, Break-Even analysis, Income Statement analysis and cost-benefit analysis.

Ratio Analysis

This module involves discussion of common business metrics with the Income/Outcome Triangle for Ratio Analysis.

Application to Your Company’s Financial Position

The Company Board® is a 3D visual representation of your current corporate financial position. This module transitions the learning from the classroom to the real world. The tie-back and discussion relate the simulation experience to your company’s concerns, measures, and goals. Can include additional visualization exercise and discussion of real world competitors.

Our Learning That Never Stops™ approach will ensure skills learned in the Income:Outcome Finance for Sales Professionals will be transferred to day-to-day work practices. To achieve this, Income:Outcome Finance for Sales Professionals includes components and activities:

Pre-Work

Prepares participants for the overall learning experience:

- An online survey measures the participant’s basic knowledge of financial terms and concepts.

- Results are shared during the workshop

Delivery Options

Income:Outcome Finance for Sales Professionals has two delivery options.

Extended Learning System

Income:Outcome Finance for Sales Professionals includes an Extended Learning System for self-paced reinforcement that ensures skills learned in the workshop will be transferred to day-to-day work practices.

NuVue will partner with your organization to measure the initial behavioral changes and business results. Our common interest is to make sure that Income:Outcome Business Basics delivers the results you seek. We are committed to helping you succeed. We will work with you to set up measurement systems to help move desired change forward and sustain the momentum of your implementation.

What our clients are saying

Request More Information on Our Solutions

Please fill out the form below or give us a call at (800) 688-8310. We look forward to talking with you!

"*" indicates required fields